Farmer Producer Company (FPO / FPC)

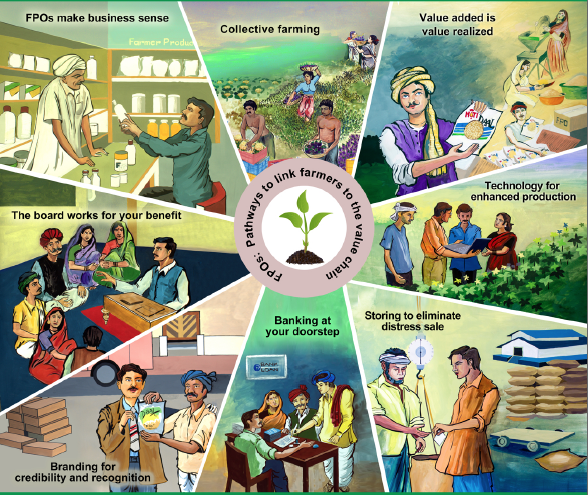

A Farmer Producer Company (FPC) is a hybrid between a private limited company and a cooperative society, specifically designed for agricultural activities and aimed at benefiting farmers. It enables farmers to organize themselves as a collective for better economies of scale, access to markets, technology, and better price realization. Below are the detailed aspects related to the Farmer Producer Company (FPC) in India:

In conclusion, Farmer Producer Companies provide a robust framework for farmers to collectively address their economic challenges by engaging in agribusiness activities. Through government support, access to better markets, and improved resource management, FPCs hold the potential to revolutionize the Indian agricultural sector by empowering farmers economically and socially.

1. Definition of Farmer Producer Company (FPC)

An FPC is a registered body under the Companies Act, 2013, formed by a group of farmers (primary producers) to improve their income by collective farming, processing, and marketing of agricultural products. It is formed to promote the business interests of farmers. The term "Producer" refers to individuals engaged in activities such as farming, dairy, fishing, livestock rearing, and other allied activities.2. Key Features of an FPC

- Legal Structure: Registered as a company under the Companies Act but operates with cooperative principles.

- Membership: Only primary producers (farmers) can become members. It can include both individuals and producer institutions.

- Voting Rights: Each member of the FPC gets one vote irrespective of the number of shares they hold.

- Objective: The primary goal is to facilitate the pooling of resources for processing, marketing, and distribution of the produce of the member farmers.

3. Objectives of an FPC

- Improve income and profitability for farmers by reducing the involvement of middlemen.

- Enhance bargaining power for better price realization of agricultural products.

- Promote sustainable farming and modern agricultural practices among members.

- Facilitate the procurement of inputs at lower costs through bulk buying.

- Offer better access to credit, technology, and markets for farmers.

4. Key Benefits of an FPC

- Collective Bargaining Power: Farmers can sell produce collectively, which ensures better pricing.

- Economies of Scale: Pooling resources allows for bulk purchases of inputs and bulk sales of products, reducing costs.

- Access to Financial Services: FPCs have better access to loans and financial assistance as compared to individual farmers.

- Government Support: FPCs receive various benefits and subsidies under schemes from the Government of India, including subsidies on storage infrastructure, transportation, and marketing.

- Exemption from Income Tax: Certain tax exemptions are available for Farmer Producer Companies engaged in agricultural activities under section 10(1) of the Income Tax Act.

5. Registration Process of an FPC

A. Minimum Requirements for Incorporation:

- Members:

- Minimum of 10 individual producers (farmers) or two producer institutions.

- There is no maximum limit on the number of members.

- Directors: A minimum of 5 directors is required.

- Capital Requirement: No minimum capital requirement; however, initial capital must be contributed by members.

- Documents Required:

- PAN card and identity proof of all directors and shareholders.

- Address proof of the company’s registered office (utility bill, rent agreement, or ownership documents).

- Memorandum of Association (MOA) and Articles of Association (AOA) outlining the company’s objectives and functioning.

B. Steps to Register an FPC:

- Name Reservation: Apply for name reservation on the Ministry of Corporate Affairs (MCA) portal using RUN (Reserve Unique Name) service. The name should include "Producer Company" at the end.

- Digital Signature Certificate (DSC): Obtain a DSC for all proposed directors.

- Director Identification Number (DIN): Apply for a DIN for all the directors.

- Filing for Registration: File incorporation documents (MOA, AOA, and necessary declarations) with the Registrar of Companies (ROC) along with the application fees.

- Certificate of Incorporation: Upon successful verification, the ROC issues a Certificate of Incorporation, and the FPC is formed as a legal entity.

6. Management and Governance of an FPC

- Board of Directors: Managed by a board of at least five and not more than fifteen directors. They are responsible for overseeing day-to-day operations and decision-making.

- General Body Meetings: The FPC must hold annual general meetings (AGM) where members can vote and discuss important issues like business performance, strategy, and dividends.

- Audit and Financial Reporting: The FPC must maintain proper accounts and conduct annual financial audits. It must file annual returns with the ROC.

7. Licensing and Compliance for an FPC

- GST Registration: FPCs must register under GST if their annual turnover exceeds the threshold limit (currently ₹20 lakh for services and ₹40 lakh for goods).

- TDS Compliance: The FPC must deduct tax at source (TDS) wherever applicable and file TDS returns.

- Other Registrations: Depending on the activities of the FPC, it may require other registrations such as the FSSAI (for food products), Import Export Code (IEC) for export, and other agricultural licenses.

8. Financial Assistance and Government Schemes for FPCs

The Indian government offers various financial incentives, grants, and subsidies to support the formation and operation of FPCs.- Equity Grant Scheme: Helps FPCs access capital by matching equity contributions made by members.

- Credit Guarantee Fund Scheme: Provides loans to FPCs without requiring collateral.

- Subsidy on Infrastructure Development: FPCs can avail of subsidies for setting up storage facilities, processing units, and other infrastructure under schemes like the Pradhan Mantri Kisan Sampada Yojana and others.

9. Taxation of Farmer Producer Companies

- Tax Exemptions: FPCs engaged in the marketing of agricultural produce grown by their members are exempt from income tax under Section 10(1) of the Income Tax Act.

- Tax Rates: If an FPC earns income from non-agricultural activities, it is taxed at the corporate tax rate applicable to private limited companies.

10. Challenges Faced by FPCs

- Lack of Awareness: Many farmers are unaware of the benefits of forming or joining an FPC.

- Access to Capital: While FPCs have access to financial support, smaller FPCs often find it challenging to raise capital for large-scale operations.

- Skill Gaps: FPCs often lack trained professionals to handle business management, marketing, and operations, which can affect their performance.

- Market Access: FPCs may face challenges in finding access to high-value markets and dealing with market fluctuations.

11. Future Scope for FPCs in India

The future of FPCs looks promising, with the government encouraging farmer collectives to improve productivity and profitability. Key growth areas include:- Agri-Processing: FPCs are expected to play a crucial role in processing and value addition to agricultural products.

- Contract Farming: As contract farming grows in India, FPCs can facilitate contracts between large agribusinesses and small farmers.

- Export Potential: With proper infrastructure and compliance, FPCs have significant export potential for high-value crops and organic products.

12. Examples of Successful FPCs

- Vrindavan Organic Farmers Producer Company: Engages in organic farming and sells products directly to consumers.

- Sahyadri Farmer Producer Company: One of the largest FPCs in India, involved in the cultivation and export of grapes and other horticultural products.

In conclusion, Farmer Producer Companies provide a robust framework for farmers to collectively address their economic challenges by engaging in agribusiness activities. Through government support, access to better markets, and improved resource management, FPCs hold the potential to revolutionize the Indian agricultural sector by empowering farmers economically and socially.

Share

- Client

- AgFintech Producer Company Limited & Multiple CBBO